While on my way to the U.S. a few weeks ago, I started an investigation. I was curious to know what the Japan tech IPO landscape looked like over the last 2 years or so. My sample included tech companies that had their IPO last year onward, had a current market cap of over 10 billion JPY (about $90m), and were founded in 2008 onward (to account for venture firms’ typical 10 year fund lives). We’ll get to why I chose current market cap rather than market cap at IPO in a minute.

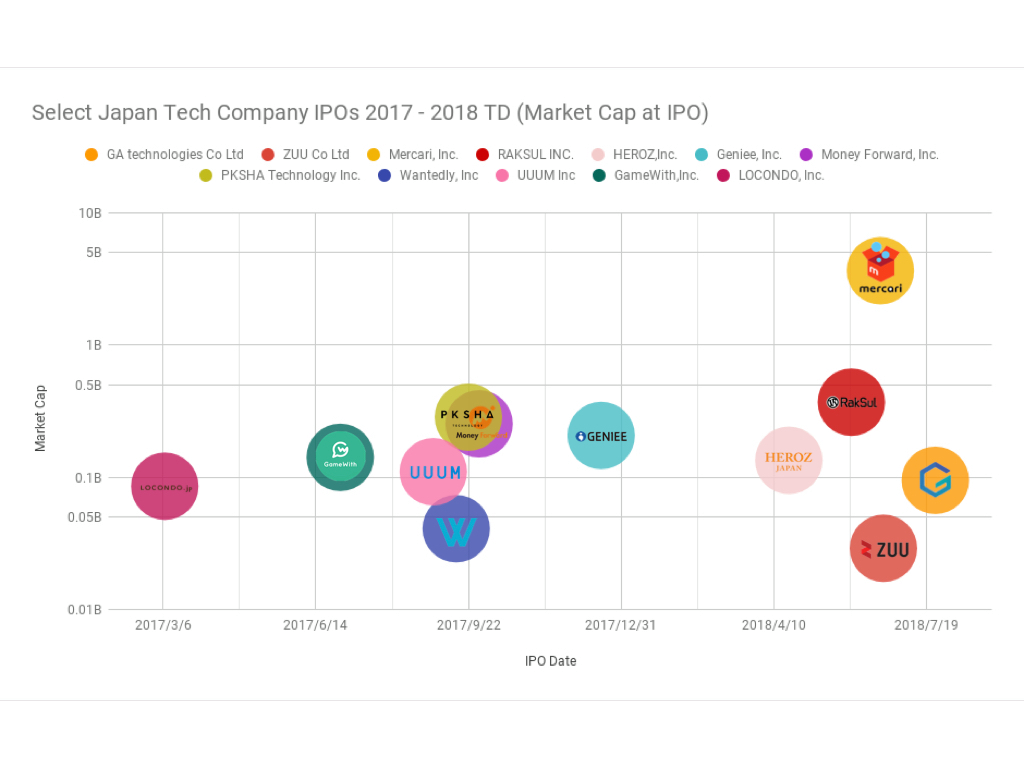

My sample with market caps at IPO looked like this chart below. The one unicorn exit was Mercari. The rest were small cap IPOs under $500m. Including Mercari, 8/12 of them were over $100m. You can interpret this in different ways. One way is, “wow, Japan really doesn’t have that many meaningful IPOs.” Another way is, “Japan has a tech IPO over $100m every 2.5 months.”

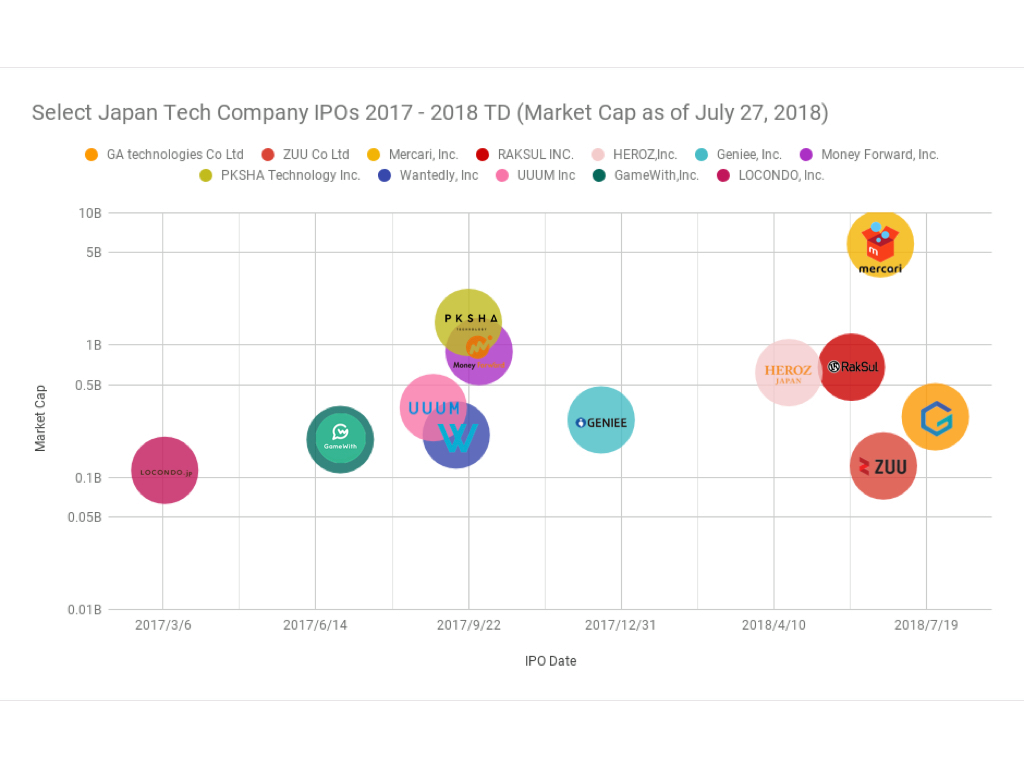

The reason I wanted to also look at current market cap is to test a statement that people in Japan’s startup world sometimes say with tongue in cheek: “IPOs in Japan are like Series Bs.” Historically, if you wanted to raise rounds of over $20m you did not have many options in the private market and therefore would be pressured to go public. Although that is starting to change, growth capital is still hard to come by in Japan. In any case, if the IPO is the Series B, then how much did the market caps increase after their “Series B?” Using the market caps as of July 27, 2018, my sample looked very different.

There were now 2 companies valued at over a billion, and 1 flirting with the billion mark at about $900m. 2 others were at about $600m. All 12 were over $100m. Not bad for a 20 month sample that doesn’t even include M&A exits. Unicorns get a lot of attention and thus are easier to write about. But since unicorns are private companies valued at over a billion, the companies in Japan that go public and then become billion dollar companies don’t get counted.

One way to interpret this is that VCs should hold on to their shares after the IPO. There are certainly some VCs that do this in Japan. That said, many LPs frown on this practice due to the fact that private markets and public markets are two very different beasts with their own set of risks. The other way to interpret this is that there is room for more growth capital for startups in Japan. If startups can raise privately and grow further before their IPOs, perhaps they can make much bigger debuts in the public markets.

Which leads me to another interesting discovery: the average time from founding to IPO was 6 years. In a global startup environment where companies can be flush with cash in the private markets, IPOs are being put off longer and longer. Getting liquidity as an investor can take over a decade. Setting aside whether this dynamic is good or bad, long waits to liquidity is not as much of a challenge in Japan.

Japan’s startup market is an emerging one but it is not a bad one. I’d argue that it doesn’t get the attention it deserves. There are winners here – and they are not just winners on paper, they’re liquid.

Notes: USDJPY 111.04, graphs use log scale, thanks to Masaya Hisakado for helping me with the data 🙂