Over the past few weeks, many journalists have reached out to us asking about our perspectives on whether COVID-19 is impacting Japan’s startups, and whether it is influencing our investment activity. The answer to both of these questions is yes.

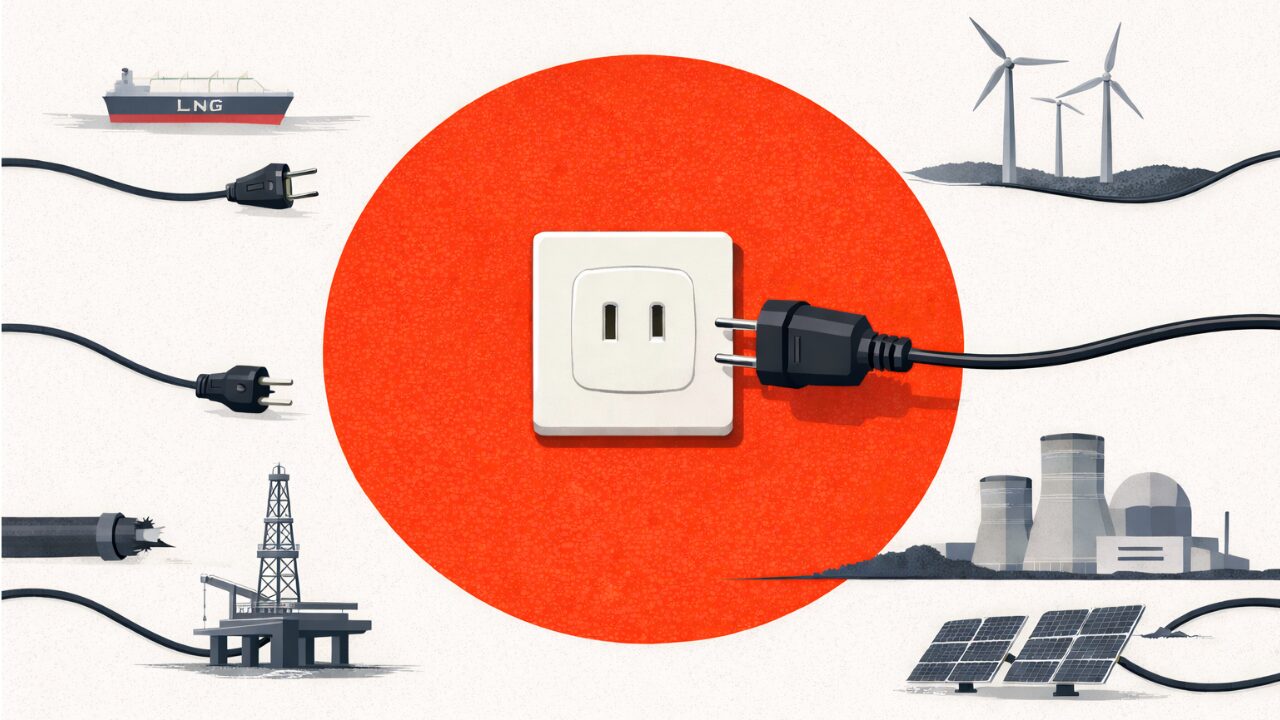

COVID-19 is impacting every company in every industry, and startups are no exception. Whether this difficult situation is serving as a headwind or a tailwind depends on industry. For online streaming, food delivery, and many SaaS companies it is serving as a tailwind. For travel, events, and offline restaurants or retail related companies it is serving as a merciless headwind. The impact varies drastically across companies.

In terms of investment activity, COVID-19 has forced us to recalibrate our investing and apply a new lens. We have not slowed down our investment pace, but we have certainly been discussing how COVID-19 has shuffled the cards of opportunities over the next few years.

Contrary to what Trump or Abe may claim or hope, this pandemic is far from over. Things are not going to go back to “normal” any time soon. As Bill Gates noted in his recent article in The Economist, our new reality will likely continue until there is a vaccine. Even if lockdowns are loosened, people will avoid crowded places that could expose them to disease. This means that airports, stadiums, and shopping areas will continue to look much emptier for the foreseeable future.

Considering this paradigm shift, we inevitably have to think about investing during this new normal, and how we approach different categories.

Travel, for example, is the hardest hit area and easiest to conceptualize. For years, inbound tourism to Japan was experiencing a golden age. In less than 10 years, it exploded from around 5 million visitors a year to over 30 million. I heard from some Japanese that it was “because of the upcoming Olympics.” But it had nothing to do with that. As the rest of Asia became wealthier, they had money to travel to this beautiful country. Visitors from China drove most of this explosive growth. Now, in an ironic turn of events, a virus from China has completely halted it. Foreign visitors to Japan dropped from 87,000 per day to just 85 in a matter of months. I am once again one of the few foreigners walking the streets of Tokyo, living through a twenty-first century Edo period.

These new circumstances don’t mean that we won’t invest in travel, or any of the hardest hit categories. But it does mean that we’ll have to invest more cautiously. We have to consider the risks involved with this situation dragging out, and how that influences what prices make sense. Even Airbnb, the greatest travel startup of the past two decades, had to raise money with 10% interest, at half of their previous valuation. Startups in the travel sector or other similarly impacted industries will inevitably have to follow suit.

Of course, things are not all bad. COVID-19 is arguably the ultimate forcing function for the “digital transformation” that has been popularized in recent Japanese business magazines. As government, education, healthcare, and other sectors grapple with how to operate during a pandemic, incumbent barriers that previously stifled innovation have been knocked down. Perhaps the most telling signal for this seismic shift is Japan’s IT Minister changing his tone regarding the necessity of the archaic Japanese corporate seal system, the “hanko.” Naokazu Takemoto, who also happens to be the Chairman of the group lobbying to protect the hanko industry, has finally admitted that there is a problem when people need to come to work during a pandemic just to stamp papers. According to him, whether to continue using the hanko is now a “private sector matter.”

We have always been heavily invested in companies following the digital transformation theme, and we’ll continue to do so throughout this crisis. COVID-19 is a horrible tragedy, but it is also an opportunity for progress. Despite the circumstances, we remain optimistic about the tailwinds created, and have no plans to slow down our investment pace.